Supporting the Increase in Withholding Tax: A Step Toward Strengthening Sri Lanka’s Tax System

Posted on December 29th, 2024

By Sanjeewa Jayaweera Courtesy The Island

The government’s decision to increase the withholding tax (WHT) rate to 10%, effective 1 April 2025, deserves commendation. Too often, political leaders have avoided necessary but unpopular decisions, opting to appease the electorate. This has led to various issues, from economic stagnation to the erosion of minority and religious rights. The proposed tax increase, however, marks a significant step in addressing a pressing concern: Sri Lanka’s persistent tax evasion problem.

Tax evasion in Sri Lanka is alarmingly high. While some degree of evasion is common in many countries, effective tax compliance is largely achieved through a comprehensive tax policy and an efficient tax administration. Unfortunately, Sri Lanka has fallen short in both these areas. Since the early 1990s, successive governments have either reduced or eliminated key taxes, granted widespread exemptions, and failed to adequately develop the Inland Revenue Department (IRD) in terms of manpower and technology.

Rather than addressing these systemic issues, governments have relied on increasing indirect taxes. The contribution of direct taxes to overall revenue has fallen to a mere 20%. Indirect taxes, such as Value Added Tax (VAT), are largely hidden from the consumer, as the IRD has mandated that supplier invoices do not show VAT charged. This has created a society that is not accustomed to paying direct taxes. Additionally, the acceptance of corruption as a necessary evil” has contributed to the perception that tax evasion is acceptable.

Consequently, the imposition of new taxes, rate increases, and threshold reductions often generates confusion and frustration among the public. Opposition parties frequently exploit these sentiments to mislead the electorate, complicating the government’s efforts. To counter this, the government must invest in educating the public about taxes, the need for tax revenue, and the civic duty of tax compliance. This is a long-term effort that, if successful, could lead to improved tax revenues and higher compliance rates.

Policymakers should consider insights from an OECD report published in 2021, which analyzed taxpayer education initiatives in 59 developed and developing countries. The report revealed that over 80% of such initiatives improved tax morale—the intrinsic motivation to pay taxes. The findings underscore the importance of tax literacy in shaping a culture where citizens understand how their tax contributions affect their daily lives.

The report suggests a step-by-step approach for designing and implementing taxpayer education initiatives customized to local contexts. Three key strategies for promoting tax compliance emerged:

· Teaching tax: Engaging all audiences, including youth, adults, and entrepreneurs, through long-term educational programs.

· Communicating tax

: Raising awareness through campaigns, tax fairs, TV shows, and behavioural economics-based messaging.

· Supporting compliance

: Providing practical assistance, particularly for vulnerable taxpayers, to navigate modern e-administration tools and fulfill reporting requirements.

Verité Research, an independent think tank, has long advocated increasing the WHT rate on interest income from 5% to 10%. Their estimate suggests that this increase could generate an additional Rs. 90 billion in revenue for the state. Despite this, the government of Ranil Wickremesinghe hesitated to act, even though it had already raised VAT to 18% and introduced progressive income tax rates as high as 36% and reduced the monthly tax-free threshold to Rs. 100,000.

Importantly, WHT on interest income is not an additional tax; it is a prepayment of taxes collected by the payer on behalf of the government, similar to the Pay As You Earn (PAYE) system used for salaried employees. The challenge, however, lies in the fact that individuals often earn interest from multiple banks, unlike salary income, which typically comes from a single employer. As a result, financial institutions cannot easily determine whether an individual’s total income surpasses the annual tax-free threshold of Rs. 1,200,000 (or Rs. 1,800,000 starting April 2025).

To address this, the IRD should implement a system allowing individuals over 18 to obtain a letter from the IRD confirming that WHT need not be deducted if their total annual income is below the threshold. While this will initially be challenging due to the lack of tax files for many individuals, it is a step that should be supported. Despite its complexities, the government’s decision to increase the WHT rate should be backed.

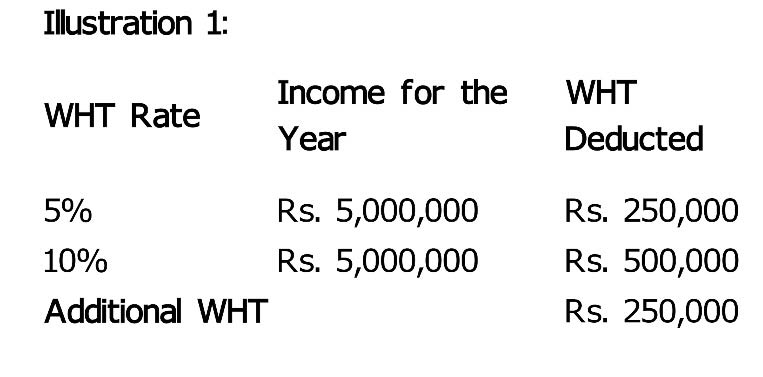

To illustrate the impact of this change, consider the following examples assuming the person’s total income is derived solely from interest:

Total Income Tax Due:

· Income: Rs. 5,000,000

· Single Person Allowance

: Rs. 1,200,000

· Taxable Income

: Rs. 3,800,000

· Income Tax at Progressive Rates

: Rs. 918,000

· Less WHT Collected at Source

: Rs. 250,000

· Tax Evaded

: Rs. 668,000

With the WHT Rate Increase:

· Income: Rs. 5,000,000

· Single Person Allowance

: Rs. 1,200,000

· Taxable Income

: Rs. 3,800,000

· Income Tax at Progressive Rates

: Rs. 918,000

· Less WHT Collected at Source

: Rs. 500,000

· Tax Evaded

: Rs. 418,000

As illustrated, raising the WHT rate to 10% would generate an additional Rs. 250,000 in tax revenue. I have assumed in my illustration that the recipient of interest income is not tax-compliant and is currently outside the tax net. This demonstrates how the rate increase could significantly reduce tax evasion. The IRD’s ultimate goal should be to recover the Rs. 418,000 currently evaded by taxpayers. By streamlining the reporting systems of financial institutions and integrating them with the RAMIS system, the IRD can take a significant step toward curbing tax evasion and boosting government revenue.